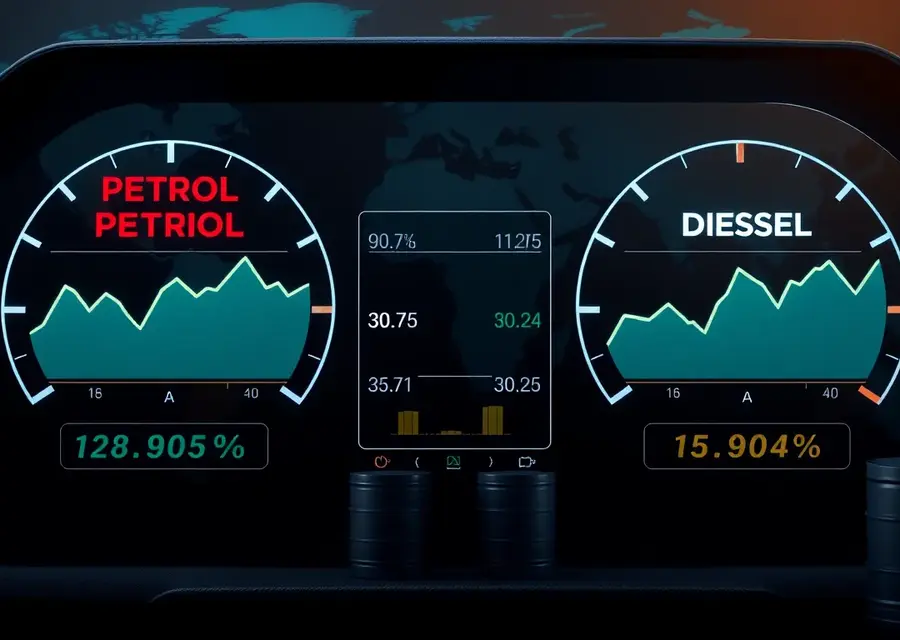

Petrol Diesel Prices: Understanding Daily Fluctuations on September 6, 2025

- THE MAG POST

- Sep 7, 2025

- 4 min read

The daily dance of petrol and diesel prices, updated precisely at 6 AM by oil marketing companies, is a fascinating window into global economics. It’s not just about numbers changing; it’s about the intricate interplay of international crude oil markets and the ever-shifting currency exchange rates that dictate the cost of what powers our vehicles. This transparent, daily revision mechanism is designed to ensure you’re always aware of the most current and accurate fuel costs, reflecting the real-time pulse of global energy commerce and domestic economic conditions, fostering a marketplace that’s both dynamic and accountable.

Daily Fuel Price Dynamics Explained

The daily ebb and flow of petrol and diesel prices are a direct reflection of sophisticated global market forces, meticulously managed by Oil Marketing Companies (OMCs). These adjustments, typically occurring at 6 AM each morning, are not arbitrary but are finely tuned to international crude oil benchmarks and the prevailing currency exchange rates. This proactive approach to pricing ensures that the domestic fuel market remains synchronized with global economic shifts, fostering a transparent environment where consumers can rely on accurate, real-time pricing information. The system, while dynamic, aims to balance market realities with consumer accessibility, a complex but essential task in maintaining stable energy economics.

Understanding the Mechanisms Behind Price Fluctuations

The intricate dance of global crude oil prices forms the bedrock of domestic fuel pricing strategies. Factors such as geopolitical tensions, supply chain disruptions, production quotas set by major oil-producing nations, and even shifts in global demand significantly impact the cost of crude. OMCs closely monitor these international developments, translating them into actionable domestic price adjustments. The volatility in crude oil markets means that consumers might see prices change frequently, sometimes even within the same day if major global events occur. This responsiveness, while potentially unsettling, is crucial for the financial health of the OMCs and the stability of the broader energy sector.

Impact of Currency Exchange Rates

Beyond the raw cost of crude oil, the strength and stability of a nation's currency play a pivotal role. Since crude oil is predominantly traded in US dollars, fluctuations in the exchange rate between the local currency and the dollar directly influence the landed cost of imported oil. A weaker local currency means that more of it is needed to purchase the same amount of dollars, thereby increasing the effective cost of imported fuel. Conversely, a stronger currency can help mitigate price increases, even if international crude prices remain steady. This interplay between currency markets and fuel prices highlights the interconnectedness of national economies on a global scale.

The Role of Government Policies and Taxes

While market forces are primary drivers, government policies, including excise duties and value-added taxes (VAT), also exert a considerable influence on the final retail price of petrol and diesel. Central and state governments can adjust these tax components to either cushion consumers from sharp price rises or to augment their revenue streams. These fiscal decisions can sometimes override or temper the impact of global price movements, creating a complex pricing environment. Consumers often look to government interventions during periods of extreme price volatility, understanding that fiscal policy is a significant lever in managing fuel costs.

Transparency and Daily Revisions

The daily revision of petrol and diesel prices by OMCs is a cornerstone of their commitment to transparency and market responsiveness. By updating prices every morning, companies ensure that consumers are not subjected to outdated pricing structures that might not reflect the current market conditions. This practice allows for a more accurate reflection of the cost of acquiring and distributing fuel. It also prevents the accumulation of significant price discrepancies that could arise from infrequent revisions, thereby promoting a fairer marketplace for both consumers and fuel providers. The 6 AM update has become a routine for many, integrating into the daily economic rhythm.

Consumer Benefits of Daily Price Adjustments

While sudden price hikes can be a concern, the daily revision mechanism offers several benefits to consumers. It allows for gradual price adjustments, preventing large, sudden shocks to household budgets that might occur with less frequent updates. If global prices fall, consumers can benefit from these decreases more quickly. Furthermore, this system encourages more informed purchasing decisions, as consumers are aware that prices can change daily. It also fosters a sense of fairness, as the price paid more closely aligns with the actual cost incurred by the OMCs at that specific time, promoting a more equitable distribution of market fluctuations.

Future Outlook and Market Trends

Looking ahead, the pricing of petrol and diesel will continue to be shaped by a confluence of factors. The global transition towards renewable energy sources may influence long-term crude oil demand and, consequently, prices. Geopolitical stability in oil-producing regions remains a critical variable. Furthermore, advancements in refining technologies and the efficiency of distribution networks could also play a role in cost management for OMCs. Consumers and policymakers will likely continue to navigate the complexities of energy markets, seeking strategies that ensure energy security, affordability, and environmental sustainability. The interplay between technology, policy, and global economics will define the future trajectory of fuel prices.

Final Thoughts on Fuel Pricing

The daily pricing of petrol and diesel is a dynamic process, intricately linked to global economic indicators and national fiscal policies. While the constant updates can seem complex, they are designed to promote transparency and reflect the real-time costs of energy commodities. Understanding these underlying mechanisms empowers consumers to better anticipate price movements and appreciate the global forces at play. As energy markets continue to evolve, the principles of daily revision and market alignment will likely remain central to ensuring a balanced and responsive fuel pricing system for all stakeholders involved.

Aspect | Details |

Price Update Frequency | Daily at 6 AM |

Primary Influencing Factors | Global crude oil prices and currency exchange rates |

Responsible Bodies | Oil Marketing Companies (OMCs) |

Core Principle | Transparency and real-time accuracy |

Additional Influences | Government taxes (excise duty, VAT) and geopolitical events |

Consumer Benefit | Gradual price adjustments, quicker reflection of global price drops, informed purchasing decisions |

Comments